This is part 2 of “Is Toilet Paper a Better Investment Than AI Stocks”

We all invest based on our experience. Our victories and defeats are deeply imprinted, leading us to subconsciously prioritize what brought success and avoid what caused failure.

In Part 1, I detailed the brutal outcome for the ‘picks and shovels’ Equipment providers of the late ’90s internet buildout, demonstrating how the combined giants—Alcatel, Lucent, and Nokia has never recovered as an investment post Internet Bubble, losing 77% of their peak value, making Kimberly-Clark (toilet paper) the superior 30-year investment.

Today, I want to open a deeper, personal wound to show why investors like me held on to those high-flying stocks so long ago in the Internet craze. The culprit wasn’t bad research; it wasn’t bad logic; for me it was due to investing with emotion. This is my story of a paper fortune—my dot-com near victory—and the emotional scars that shape how I invest in today’s AI market.

Today’s Market Darling vs. My Personal Rocket

Today, the stock market darling is Nvidia (NVDA). No surprise there; it’s at the heart of making A.I. work, and without it, A.I. innovation would be years behind. Its stock performance has been astronomical. NVDA has soared from approximately $10 to a peak $200 (split adjusted) in five and a half years. That’s a 20-bagger (20 times your original investment). It has truly rocketed.

My own investment scars started with my investment purchases in the Dot-Com era. I had bought small pieces of the telecom equipment companies mentioned in Part 1 but eventually I found my own version of Nvidia.

My major investing bet was on Check Point Software (CHKP), a company that invented the first successful commercial Firewall in 1994. A Firewall is your “body guard” protecting your computer network. In the mid-90s, when everyone was getting connected, everyone needed security. I bought CHKP sometime in late ’96 to early ’97.

CHKP: A Market Dominator

For context, CHKP dominated the rapidly growing firewall market in the 90s. Three decades later, CHKP is still a solid company and remains one of the top four IT security suppliers globally. Just like the telecom giants in Part 1, CHKP was not a speculative ‘Dot-com’ name; it was a foundational technology. With first mover advantage. My high-conviction bet on a market dominator is what led to my on paper 20-bagger .

The 20-Bagger Mistake: When Money Met Emotion

I believed in Check Point’s product. But at the time, I was also reading about a phase of investing called “di-worsification”—the idea that you should make only high-conviction, concentrated stock investments. I thought, why buy losers? I’ll just bet big on my biggest winner. A little bit like momentum investing.

I started small, but over a very short period, I essentially put all my investment dollars into CHKP as it climbed rapidly.

How rapidly? It became a 20-bagger in three years.

earned honestly no doubt

It was life-changing money… if I had sold. I turned $55,000 into $1.1 million on paper. At 28 years old, that paper wealth—equivalent to $2.1 million today, indexed for inflation, was intoxicating. The high I felt was identical to what many investors chasing Nvidia (NVDA) or other AI infrastructure darlings are experiencing right now. The companies are different, but the rush and the paper money are the same.

This experience has shaped my investing ever since. Let’s dig into the hard lessons I learned at the moment.

My Lessons from the Dot-Com Bust

Lesson #1: Don’t let Emotions or Self Belief get involved

For 3 years I tracked the CHKP stock price everyday. Multiple times a day. It went up 8 out of 10 days. I was “trained” for 3 straight years that my stock: Just. Keeps. Going. Up.

I was hooked. I was an addict. Many days the stock was moving upwards, weeks and months worth of my salary. Near the top, CHKP stock would sometimes move as much as my yearly salary. In one day. Both good and bad. It was a rush. There was no other way to describe it. It provided strong emotions, both fear of loss and greed of more gains. Kinda like the Dark side. Very strong emotions.

Being right on a stock makes you feel like a genius. The higher it goes and the longer it runs, the more confident you become in your decision. Soon, you start talking to everyone about your fantastic pick so they know how smart you are. You become emotionally tied to your stock.

Eventually you start thinking: “Wait, I am good at this! Let’s invest more money!” I began shoveling new savings from my day job into one other new stock in the Computer security space. It was late in the cycle around the end of 1998 and throughout 1999. I was chasing the high. The high I got from watching the value of my stocks going up.

Lesson #2: Buy the Dip Works—Until it Doesn’t

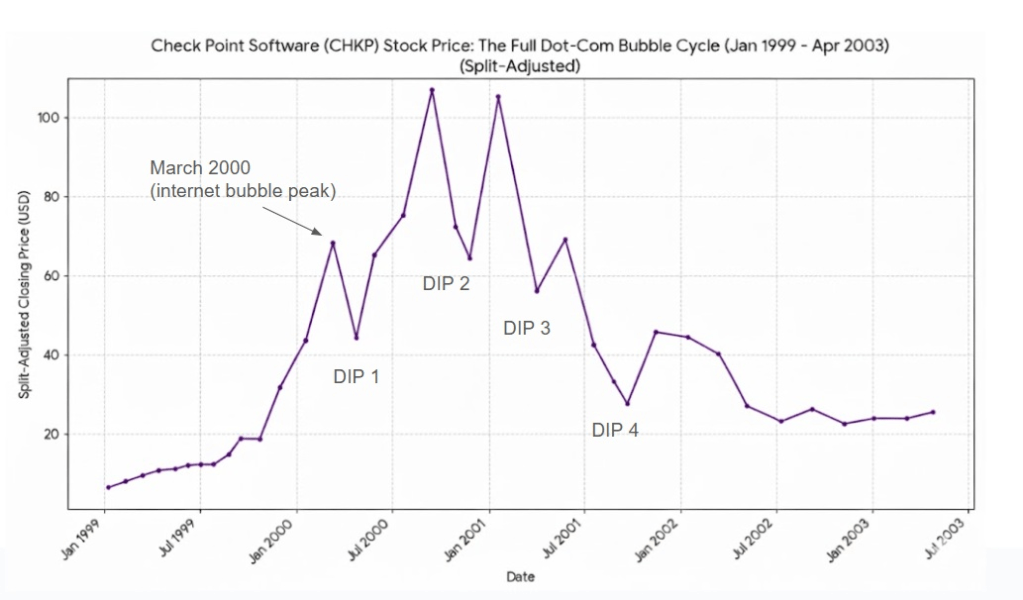

My CHKP chart was a clinic in emotional warfare:

- DIP 1: The first major dip was close to a 30% pullback. It not only recovered in three months it made a major new high within seven months. This was happening as the overall stock market was dropping. I’m a genius for holding on!

- DIP 2: This one maxed out at a 40% dip that swung violently over six months, but the stock stayed near all-time highs. Super Genius. I know what I was doing. Nowadays they would call that Diamond hands.

- DIP 3 (The Crash begins): The next dip was a 45% dip in a three-month period. I had faith it would come back like DIP 2. “I know what I am doing,” I repeated to myself. The stock recovered 20% of that drop. I was still up big. I can wait. It will come back

- DIP 4: Over six months, the stock plummeted 60 to 70% more. Now I was scared. Depressed. Should I lock in my profits? I stalled. I still had a 5-bagger, I convinced myself. It will come back. I was trained to have faith.

Looks all downhill from here Clark, better send the children first

The Rest of the Story

I finally sold the stock a couple of years later when I needed the money for a house. I had an 80% total gain on CHKP. My 20 bagger turned into a 1.8 bagger—a painful fraction of the paper profit. Worse, the losses on my other late-cycle investments wiped out nearly all of those gains.

CHKP was a great company that invented its market, but eventually, its market share, prices, and margins were squeezed as competitors, like Cisco, came into the space. Software and ideas can be copied, and eventually, competitors will enter any lucrative space.

Worse yet, CHKP customers slowed their spending. Because they had too.

Takeaways

Looking back, I realized I started investing because I had money, and everyone else in high-tech was doing it. Like your parents would say – If your friends jump off a bridge would you? Well a lot of people jumped during the internet bubble. It is all we talked about.

In 1996, 37% of the U.S. owned stocks or mutual funds. By 2000, that number hit 50%—a huge jump in four years. I had no specific goals; I just wanted to join the crowd. When I was rewarded, I became addicted to it. I was part of the herd. Near the front.

Nothing marks the beginning of the end.

Many people think back to that time frame, or they look at the graph zoomed out and they think it was so obvious. Why didn’t you sell? It was not that simple. The majority of the fall took 10 months to happen with several large gains or retracements. People were buying the dip.

If you reflect that most people had held through multiple months long dips then you can see why not many people sold near the top. They had faith it would come back. It had been good for years.

Here are my final, hard-earned takeaways:

Investment Principles

- Goals Define Strategy:

- You must have defined life and financial goals to drive your investment strategy. No goals means no clear reason (or courage) to sell or take profits.

- “More” is not a goal. “More” is an addiction. Time Independence, pay off a house, new car, college – those are goals

- Check Your Ego:

- Don’t confuse good fortune, timing, or a rising tide with superior skill. We rarely give luck the credit it deserves.

- Diversify Across, Not Within:

- True diversification means making several bets across different sectors and asset classes to mitigate concentration risk. Buying multiple stocks in the same sector is not diversification. Buying a house is.

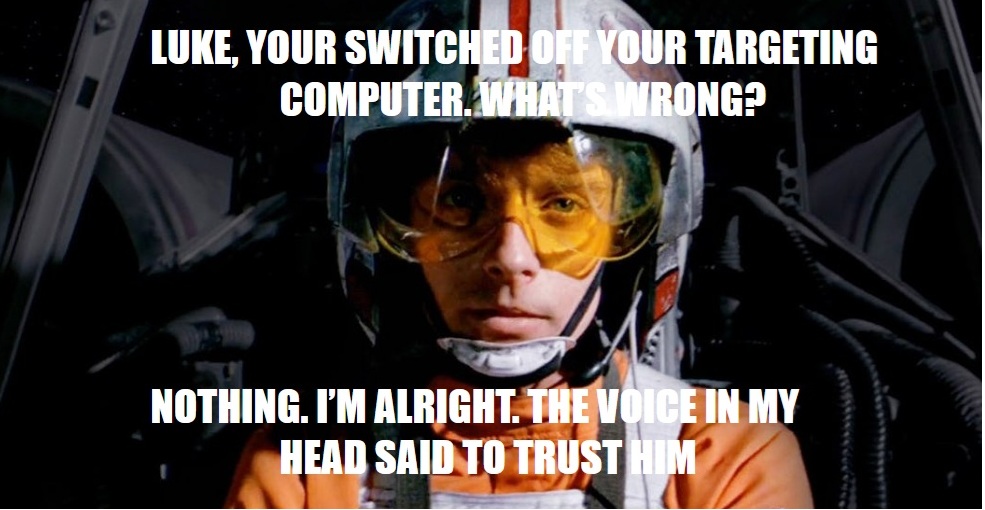

- Invest Like Spock:

- Separate emotion from decisions. Base financial choices on logic (Spock) rather than being influenced by personal distress or strong feelings (Vader).

- Lock in Life-Changing Cash:

- If a profit is large enough to materially improve your life, take some off the table. Don’t chase an arbitrary “cool number” only to watch the profit vanish.

- Pay the Tax:

- Taxes are simply the cost of winning. Minimizing tax is good, but avoiding capital gains tax is never a good reason to hold onto a high-concentrated position.

- Respect Market Sentiment:

- You cannot fight the herd. When market sentiment turns negative, it will eventually affect even the best companies and their revenues.

- Stock price growth typically requires revenue growth. Sales eventually will slow when build outs are done

The high-stakes gamble I made with Check Point taught me one of the most brutal, yet vital, lessons of my investing life: the market doesn’t care about your paper profits or your feelings. That $1.1 million paper fortune was the price I paid for confusing a period of exceptional market luck with personal investment skill.

This experience is the psychological foundation for my current skepticism. In Part 1, I was shocked by the data showing that toilet paper outperformed some of the biggest the internet equipment builders. The lessons of this paper fortune on CHKP(Part 2) explain why my personal experience makes me skeptical. It doesn’t mean I am right. Its my experience. They are my scars.

The combination of ego and emotional addiction can prevents investors from locking in life-changing gains like it did to me. Best piece of advice I can give is to explore why you are investing the way you do

We don’t know if we are in the 2nd or 8th inning of the A.I. stock returns. There is no way to know. So stick to a plan.

Ultimately, whether you’re chasing the next NVDA or aiming for steady long-term growth, the best security isn’t found in a stock’s price—it’s found in a defined strategy and the discipline to execute it, regardless of the market noise.

My conclusion for me ? I’m loading up on toilet paper. Crapper’s Full

Carl let’s me visit with my RV around the holidays

Leave a reply to VaderonFire Cancel reply