I have a confession that anyone pursuing or already living Financial Independence (FI) likely would also confess too. It’s a trait I see in some FIRE people, and it’s a bad habit I wish I didn’t share. It’s a pattern I need to end with a single decision to benefit my life.

I spend an obsessive amount of time watching the stock markets.

I watch stocks a lot. And not only stocks I own but stocks I might buy, stocks that I would never buy, stocks in the news, etc. How are the earnings reports? Is the dividend changing? What are the trends. I even watch stocks I used to own. Was it lower than when I sold?

I consume “money porn.” When I have access to CNBC, I have to watch it—thankfully, I don’t have it at home.

There is an article from BARRONs finance saying the market is going to go up. I have to read it. Oh wait there is an article on the market going down – got to read it.

I act on zero of it. I want to believe I might—that I’m putting together some grand stock portfolio that will take me to the Promised Land of vast riches. The amount of mental energy it absorbs is off the charts.

It has become a habit I have been doing for 25 years. I enjoy it and it is become entertainment in some sick way. Have a buddy who likes to talk stock – great let’s do it. But this stock watching is just a pattern that does not / has not ever served me. Its no different then tracking a favorite sports team or fantasy league.

Sadly it causes me stress even when I am invested conservatively in boring, stable income producing companies. I have stress that the market will roll over and take everything down. Then I have stress that stocks are going up and FOMO hits. Then I get relief when the market drops and I am not in it.

This roller coaster, that I am mostly watching, causes me stress for no reason. It’s freaking weird and quite sad if I step out of it and think about it. I’m like a person at an amusement park watching a ride: I feel all the same gut-wrenching emotions the riders do, even though I’m standing on the sidelines.

If you saw me doing this, going through all these emotions, just watching a ride at Disney or Universal you would think I’m real special.

I admire the bloggers or podcasters who are Bogle heads. They set their stocks/ bond allocation and forget it. 60/40, 70/30, 80/20. Just pick one. Each month if they have cash they just invest it automatically in an ETF. There is no thinking. I am sure some track it closely but for the most part they have accepted their strategy and they don’t think about it.

More importantly they have made a decision and stick to it.

For them it starts with faith. That the market will go up over time. The pluses will outweigh the minuses. They have lived through crashes. They know changing strategy is not something that will do them any good. Everything the data says to do.

What if the world is going to hell and the next great depression happens? Just invest, roll with the punches, and it will get better. Only the Magnificent 7 are holding up the market this year and representing all the gains? Great they have gains – they don’t care which company provided it.

These Bogle heads have been rewarded financially. Rewarded well. Since Jan 2020, the S&P has returned 134%. Or yearly average returns of 15.4%. And there have been a couple of rough patches in that time that they had to ride out – Ukraine / Russia war, Israel / Palestine, high inflation, Tariffs, and the global Covid pandemic. Still up 15.4% a year. What’s next?

They have faith. They will weather the storm. They will enjoy the calm seas. They are right.

The people who are comfortable with the strategy I doubt even track the stock market more than a few times per year. There is that old study that says the best investors are dead people. They just buy, die, and hold. I am not willing to go that far.

I wish I was like the index and forget it crowd. So why don’t I do it? Let the armchair self psychoanalyze begin:

The biggest reason has nothing to do with money but more to do with life and who I am. As confessed in an earlier post my investing is controlled way too much by emotion – The ‘Rabbit Investor’: My Path to Early Retirement. I wish for the logic side to win the argument over emotion but it doesn’t. This market watching has caused my sleep at night indicator to be set on conservative.

It may also be related to my career in some small way. When bored I look for stress I touched upon it in an earlier article The Stress Vacuum: Why Retirement Won’t End Anxiety.

But this hobby of watching the markets may be another way I look for stress. A way to generate strong emotions to replace what work doesn’t really provide for me. I generally am at my best when firefighting at work. When work is boring I need create my own fires.

It may also be related to getting close to my retirement. I am getting more conservative as I get older. Retiring is more important than a big return. I am in protection mode on what I have. Likely too protective.

So what should I do about it (besides therapy)?

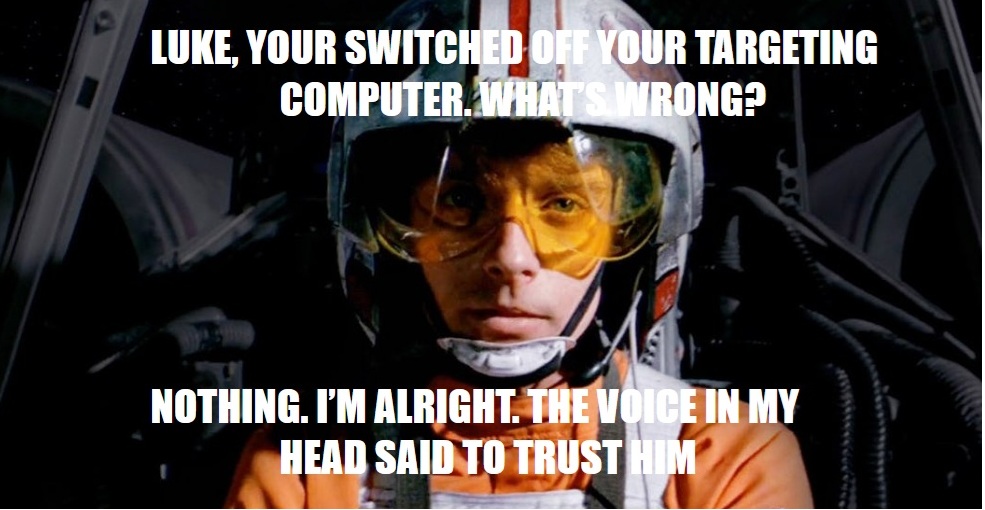

It comes down to finding a strategy that works for me. Just like I want to retire from work I also want to retire this bad investing / stock market watching habit. For me I want to combine a Jack Bogle philosophy with one I heard from a Tim Ferriss podcast which in the end boils down to the same idea.

Tim’s theory is that one decision eliminates a hundred—or a thousand—other ones. For example, to stop people from sending him books to review, he makes a blanket statement: He is not reading any new books this year. Full stop.

This prevents people trying to get a foreword, an endorsement, marketing, anything that the Tim Ferriss brand would bring to their books. People stop chasing him. He no longer has to filter which books he will support. No more decisions – no more mental energy.

This is what I need to do for my own mental sanity. Decide to go to a 70 / 30 or 60 / 40 or 80/20 portfolio. No individual stocks for any reason. I am not smarter than the next guy and I do not have better info than anyone else. Just remove this part of my life and put it on auto pilot.

Just buying a index fund would eliminate tracking of stocks I find interesting. I wouldn’t need to track stocks daily if I own all of them. Hundreds of hours of free time await.

It would free up so much space for me. It would change my habits. I would change my internet rabbit-holing habit. It would leave space for more important interests. The waste of time would be gone. Overall my investing will be much better than what it is now.

Scrooge Mcduck, my favorite comic as a child – surprise, surprise – thought about money all day every day. Protect it, grow it, hide it, swim in it, sleep with it. I don’t want to be that guy. Scrooge had great adventures but also was always under stress. It’s no way to live

Making this one decision would be a small pivot in my life, but one with a massive impact. It’s the difference between being an anxious spectator and a truly Free investor. It would reduce daily stress and get rid of a bad habit that no longer serves me in any way. It would free up space in life.

Let me worry and stress about that a little bit.

Leave a reply to meoates1 Cancel reply