Accepting that we are almost FIRE is hard for me. Knowing we have enough money to retire is hard. It’s difficult for 3 reasons. Is the nest egg big enough? Is it generating income? Will the income cover expenses?

Simple right? Just math Vader – figure it out.

Retiring means accepting you have enough saved to meet all the prescribed “Retirement rules”.

It’s meeting the 4% rule. This rule means you have 25X your annual living expenses in liquid assets.

It’s about having 1 to 3 years of cash saved up to ride out market swings. For me this is important as emotions influence my investing way too much.

It’s to have money set aside for big purchases in your budget like a new car.

It hopefully means you do not take Debt into retirement.

It’s all part of it. It is the definition of having enough money to retire.

Our nest egg is enough to survive the day to day bills and big enough to handle out of left field events for a period of time. We meet all of these requirements to officially retire in 1 year.

We would not be “Fat” Fire but we would also not be “Lean” fire. Fat fire is living the high life spending money like there is no tomorrow. No budget and no worries. Lean fire is having as low as expenses as possible so what income you do generate can cover it.

In this metaphor we are likely at “The ex high school athlete with a few extra pounds around the waist” Fire.

Another reason it’s hard to accept we have enough has to do with taking action. It is about what I need to do with the nest egg, going forward, to provide that necessary income. To have it invested correctly in the stock market. It will provide for your retirement life if invested right.

So just invest it in an index equity bond fund at a 60 : 40 ratio and forget about it. This will beat inflation and pay enough to stay ahead of the game. Look at the market zoomed out. It always goes up and to the right. Don’t worry about down turns. It always comes back.

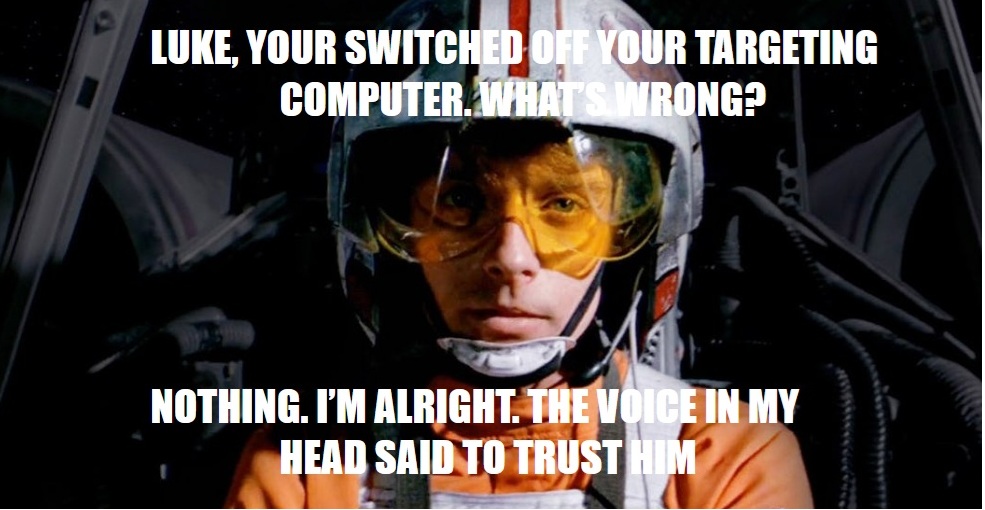

That is the logical side, the Light side.

But then “What if” shows up.

That bad things could be around the corner. Lots of bad could really shrink the nest egg. How about market crash that goes for years? It could be different this time. Maybe another depression or world war is right around the corner? It is emotion. It is fear. It is the Dark Side. And it prevents me from investing the way I need to generate that income.

What has come before doesn’t mean it will continue. Look at Japan. Look at the 2000 bubble I lived through. Can I ride out the next big downturns in the stock market? How close was the 2008 Great Recession to being the next Great Depression? How close was COVID to being much worse? Can I sleep at night invested in the market? Is the Emperor really dead for the 2nd time and won’t come back?

The last reason it’s hard to accept is the recent seemingly never ending increasing cost of life. I need to be safe for me but maybe I should also do more for my kids.

With house prices racing away from normal day to day wages, how can my kids have the life that I had? That their grandparents had. Houses in many major cities in Canada are averaging close to a million dollars. In some cities more, much more. That seems impossible for young adults today let alone older adults.

Maybe I am wrong to retire during these fantastic years of a high wage. Maybe I should plan to help my kids more. Maybe I should give them a bigger head start life. It’s now or never

Maybe I should get the bigger Death Star with the kitchen that Padme has always wanted. Maybe we should take better vacations. Maybe we should treat ourselves more.

Maybe…

And that voice is always there. It is enticing to me. It is swaying me. Join the Dark Side, make more money, get more things. You owe it to your kids, your wife, and yourself

“What if” seems to linger and it’s never far away

Those are the reasons that I find are hard to overcome . And all retirees must do it or they will never retire. And I struggle with it. A lot. Kudos to all the ones who have come before me and have ridden out downturns and are still in the market.

Regardless of my logic knowing I am good I still fear the long tail events that may happen. It keeps me working. It keeps me wasting time in my life that I shouldn’t be wasting.

Do I have the answer? No or I wouldn’t have taken this job. Am I planning on winning over the next 1 to 2 years. Yes.

Tune in for the struggle

Leave a reply to JSD@escapingavalon Cancel reply