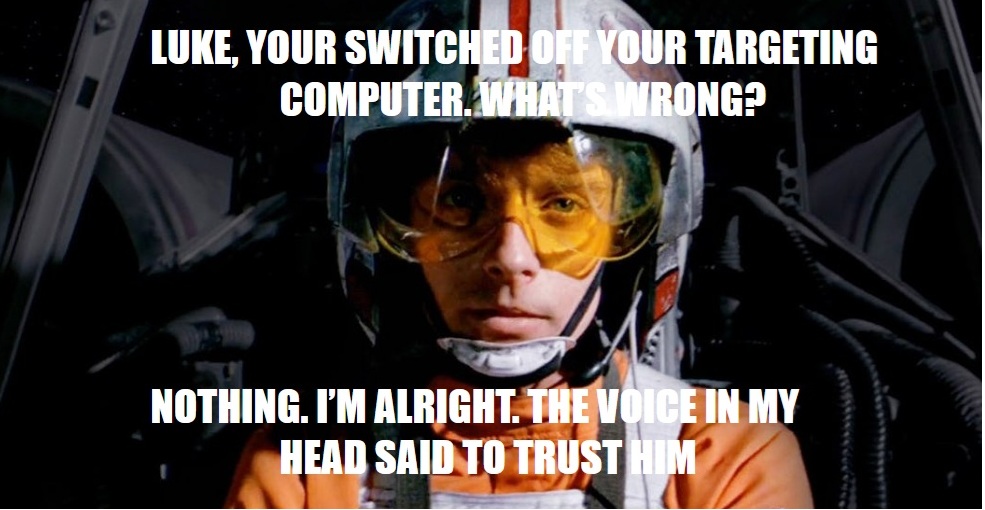

Keeping up with the Joneses—or in my case, the Palpatines—is a well known path that leads away from FIRE (Financial Independence, Retire Early). It definitely leads away from early retirement.

We all choose how we spend our money. Some people splurge in life; as money comes in, it goes right back out. And if more comes in? Great, more can go out. The FIRE community can get very judgmental about this. We forget that the main goal in life isn’t necessarily to retire early, but simply to be happy. We all define happiness differently, and not everyone shares the goal of early retirement.

I saw an old friend last weekend, and we are a perfect example of two people who took completely different paths.

I like to think I’m careful with my money. I don’t buy big stuff, and I save a fair bit of my income. I live in a house that’s small by today’s standards. I drove my minivan until the wheels fell off. We take nice, but not extravagant, vacations. We also have a small cottage on a lake just two hours away thanks to some fortuitous stock market timing during the dot com bubble.

I don’t really have any habits that drain my bank account. Because of this, I can retire soon without much issue.

My friend is the opposite. He’s always leased two nice cars, one a Porsche. He used to have a racing hobby (actually racing, not just watching). He has a nice, large house. Now, he’s bought and is renovating a beautiful, custom-built house on the ocean, a two-hour plane ride away. It’s a dream place—a friggin’ movie-quality retreat with no neighbors close by, just the ocean and rolling waves. Twenty steps out his bedroom door and you’re in the water. It’s a $1.5 million part-time residence that he designed and built.

I have always envied his life because it seems so much larger than mine.

We’re the same age, we lived together in university, yet we’ve lived two different ways. He has definitely made more money over his life than I have, but not magnitudes more. We’re in the same ballpark income-wise, but to continue the metaphor, he’s in front-row seats on the third-base line, and I’m ten rows back in the outfield.

He likely won’t retire until 65 or later. He runs his own business, and he is the important cog that makes it go. The more he works, the more he makes. If he steps back, he makes less.

In the end, my and Padme’s net worth is larger than his and his wife’s. We saved a good portion of what we earned; he has spent all of his and more. His expensive lifestyle comes with significant mortgages and car payments. Our lifestyle, on the other hand, will allow me to retire 12 years before he does (if he ever fully retires).

And I am honestly sitting here not knowing who has had the better life or who has made better choices. His life has always looked fun. For him, money is a tool for fun; money is meant to be spent. He has always had faith that he will make more money to keep paying for the way he lives. In many ways, I am envious.

At times, I wish I lived his way. Or at times, I wish I could just reach my magic number, then go out and splurge on an ocean retreat like he has. He sees his house as a vision and an asset. He’ll enjoy it for a few years, and if need be, he’ll sell it down the road and likely recover a good portion of his money. Even if he doesn’t, he will have lived in his dream spot for a few years.

But for me, I just see the $1.5 million bill. I see it as money that would disappear, that I couldn’t get back, and that if I spent it, I’d be screwed. By not spending that money, I have the flexibility to do anything I want. I have the luxury of time to explore. Yet, there is this little feeling inside of me saying he is right and I have been wrong.

I will likely never do anything that big or extravagant out of fear. Yes, I have my time now—my chance to retire—but I am scared I will live small. I have traded decades of my life for a retirement shaped by scarcity where he lives from a place of perceived Abundance.

Will I live a less-fulfilled life than I could have if I were more like him? The house truly was beautiful, and it impacted me, somehow making me less sure about retiring.

The typical FIRE post would have me put him down for spending or wasting the money he earned. He admits he could have made better choices when the good times were rolling, and he may have some regrets, but he has always recovered. I can’t knock him for the life he has led. It has taken a kind of courage I don’t think I could have had.

To each their own. There is no right way to spend. I am a little jealous of his life, and he is likely a little jealous of mine in certain ways.

I think the key takeaway here is that we are who we are. We all look at people who are different than we are and wish we could have their life in certain ways. We wish we could experience the other side because it is foreign to us. It’s a different story. A different book.

And different always seems more fun than the same old, same old. It doesn’t mean it is, but maybe that is partially what retirement is about: living a life different from the one you have now. Doing something not in your comfort zone. The other side looks fun.

I have said it before and I will say it again. Comparison is a deadly game. There is always someone who has it better and always someone who has it worse. In this case though I am wondering which one am I?

Maybe I do need that ocean house, Padme.

we all come to a fork in the road

Leave a comment