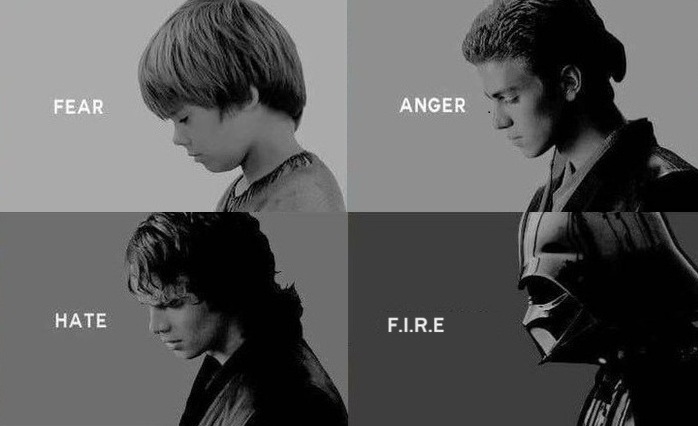

What makes us tick? Much of what we do are subconscious learned behaviors. Our parents have an outsized impact on our beliefs, especially concerning money. When we are young we watch what our parents do to learn how we are suppose to act. If we don’t examine these deeply rooted patterns, we risk suffering from Generational Money Trauma.

It’s time for some self-therapy to understand why I still struggle with the idea of having enough to retire.

First off I love my parents, good traits and bad. The older I get and the more I know about their stories, the more I realize how money trauma shaped who they are. Which in turn shapes me. Nurture goes a long way back. Generational in fact

My dad built a blue-collar business, putting in 60 to 70 hour weeks to get ahead. He was the Jedi Master of his peer group, outworking many others including his own father and siblings in the oil industry. Combine the hard work with good business decisions and my dad was quite successful.

My mom was a stay at home mother raising kids and doing the books for the business. Not easy as dad was always at work.

Both of my parents came from families that struggled with money when they were kids. Being born in the mid to late forties their families struggled to get by. There just was not “middle class” at that time of the late forties. Both of their families survived hard times by owning small farms and working second jobs. My parents were old enough to know what being lower income felt like and it formed who they are.

My parents liked having money. We all do. They always had new vehicles and spent money when they wanted too. My parents weren’t that outwardly showy, besides the vehicles, but talked openly about money a lot. Especially when people were around. They were proud they had plenty and it was not hidden. Both parents judge others by wealth. It was their yardstick of how well they were doing. Money is a core part of their self-worth.

Why do I share this? Because I inherited these beliefs without thinking about it.

I know I have been obsessed over having money from a young age. I know I compare myself to others. It may not show outwardly, I hope, but mentally it just happens. I fight it but I do have a competitive side. Growing up I was taught money is the game of choice, our family sport. I see it in myself and it’s almost a reflex. The emotional side of me does not like that I am this way.

Money has always been the main reason when I am considering switching to a new job or a new company. Not will I like the job more but how much money does it pay? Like a bounty hunter. It has led me down the wrong career path. I would have been more satisfied or happier doing something else. The golden handcuffs have released me multiple times but I quickly look for the next set.

Day trading has been good to him

Having this deep need for money also has led to a fear mindset. Once I have money I don’t want to lose it. I don’t risk it. It is part of who I am. It probably has caused me to be cheap. It probably has caused me unnecessary anxiety.

Money is part of my self worth. Like it or not my self worth is impacted by the nest egg going down or up. It is likely why I am so conservative in investing. I would rather not lose then invest it correctly for potentially bigger gains.

I may not like it but I have the same belief as my parents on the importance of money. This brings me to my inherited truth:

Core Money Belief #1: “Money is very important in life; have lots.”

It is a bigger part of my beliefs than I care to admit to myself. This belief is part of my DNA.

But my dad’s example, even with his wealth, shows the trap. At 80, when he should be enjoying life, money is still his focus. He holds onto decades-old family grudges about money—his Dark Side still holds anger and resentment. All his siblings and parents have passed away but he still has not forgiven them for issues that date back 40 years. Keeping score impacted the relationship he had with his family

He accumulated wealth like a true FIRE pioneer but never learned to let go of the scarcity mindset. When he should be forgetting about money and just be enjoying life, money is still too big of a part of who he is.

His experience taught me a vital lesson for a successful retirement:

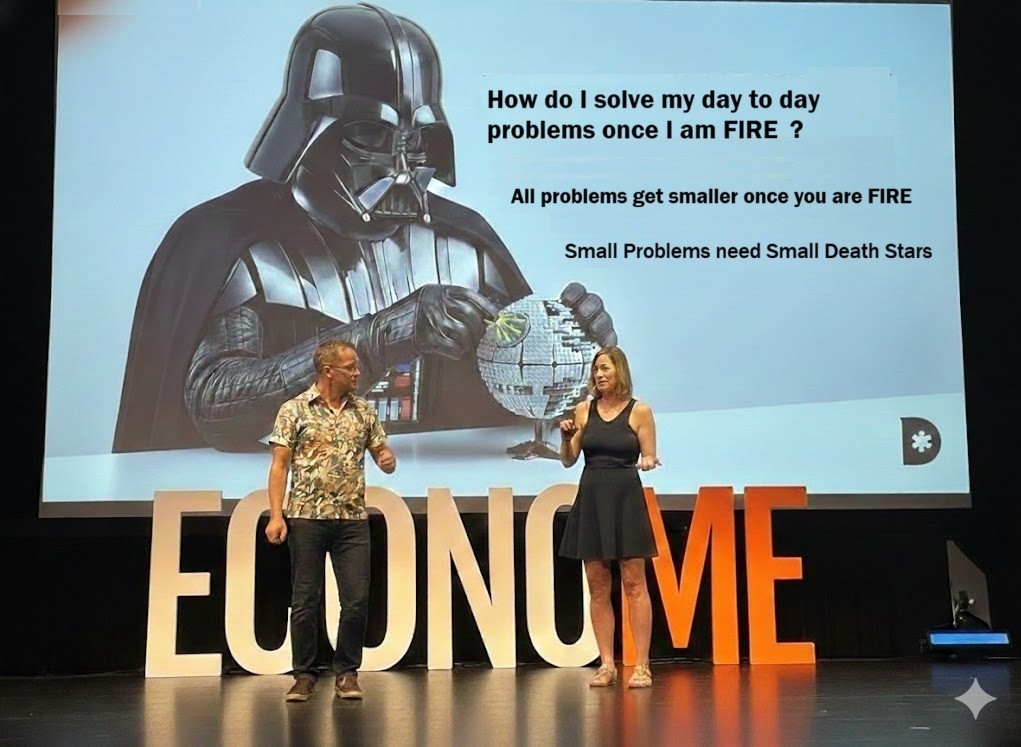

Core Money Belief #2: “Let it Go. Once you are FI, stop focusing on the money.”

I hope that I can let it go. This is key to any successful FIRE person. It’s no secret I struggle with the importance of money. But once you reach the point where you are FI and can live the lifestyle you want, money needs to be the last thing on your mind. Or more importantly the last thing in your heart

“A wise person should have money in their head, but not in their heart.” – Jonathan Swift

My goal is to not follow my parents’ example in retirement. Money is supposed to be a tool to fuel your life, not the central focus of your life. It has a been an obsession to get to FI but once I am there I need to change my mentality. Not easy to do.

I know I have Core Money Belief #1—”Money is important”—but I’m actively working on adopting and living by Core Money Belief #2—”Let it Go.” I’m doing this to forge my own path and truly enjoy what life can be.

It’s also crucial that I stop passing these unhealthy generational money beliefs on to my own kids.

I think I can, I think I can, I think I can… Wait, is that a shiny penny? Damn.

Leave a comment